of the Securities Exchange Act of 1934

☒

☐

| Preliminary Proxy Statement | ||||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| Definitive Proxy Statement | ||||

| Definitive Additional Materials | ||||

| Soliciting Material | ||||

| ☒ | No fee |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

6, 2020

Shareholder,

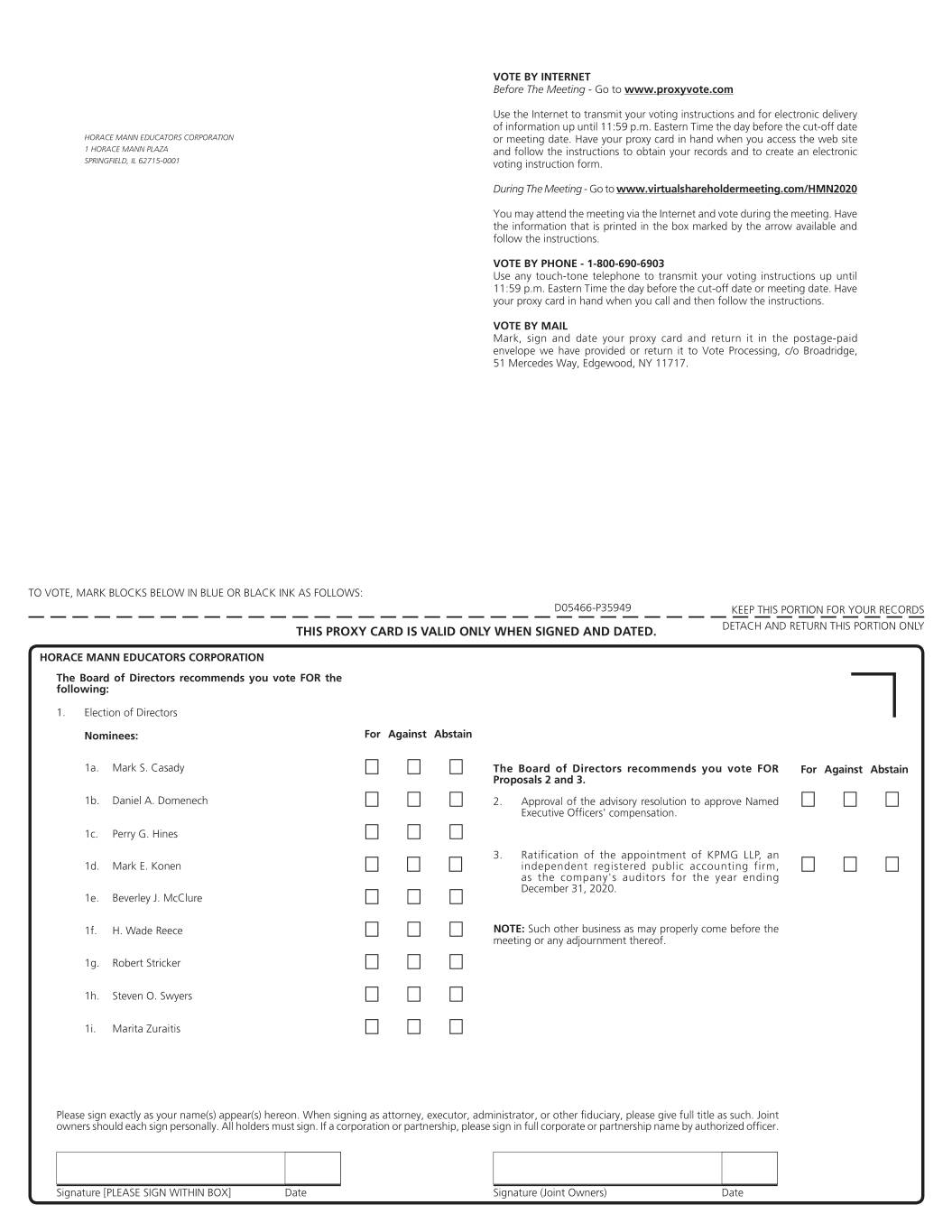

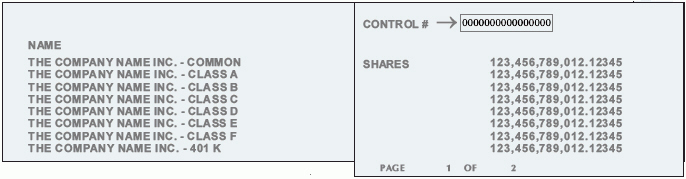

Internet. You will be able to attend the Annual Meeting and vote during the live webcast by visiting www.virtualshareholdermeeting.com/HMN2020 and entering the 16-digit control number included in our Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials.

as possible.

|

| ||||||

|

| ||||||

|

| ||||||

|  | ||||||

| H. Wade Reece | |||||||

| Chairman of the Board | |||||||

|  | ||||||

| |||||||

| President & Chief Executive Officer | ||||||

ANNUAL MEETING OF SHAREHOLDERS

HORACE MANN EDUCATORS CORPORATION

When

Wednesday, May 25, 2016

9:00 a.m. Central Daylight Saving Time

Where

Horace Mann Lincoln Auditorium

1 Horace Mann Plaza

Springfield, Illinois 62715

Why

|

|

|

|

Record Date

March 29, 2016 - Shareholders registered in the records of the Company or its agents on that date are entitled to receive notice of and to vote at the meeting.

The approximate availability date of the Proxy Statement and the proxy card is April 11, 2016.6, 2020. Your vote is important.Whether or Even if you do not you plan to attendparticipate in the Annual Meeting, the Board of Directors urges you to vote via the Internet, by telephone or by returning a proxy card.If you vote via the Internet or by telephone, do not return your proxy card.You may revoke your proxy at any time before the vote is taken at the Annual Meeting, provided that you comply with the procedures set forth in the Proxy Statement whichthat accompanies this Notice of Annual Meeting of Shareholders. If you attendparticipate in the Annual Meeting, you may either vote by proxy or vote in person.

electronically during the virtual meeting.

Ann

Carley

April 11, 2016

HORACE MANN EDUCATORS CORPORATION

| Proposal | Board vote recommendation | |||||||||||||

| Election of Nine Directors

(page 4) | FOR each director nominee | ||||||||||||

Advisory Resolution to Approve Named Executive Officers’ Compensation (page 15) | FOR | |||||||||||||

Ratification of Independent Registered Public Accounting Firm (page 41) | ||||||||||||||

|

| FOR | ||||||||||||

ANNUAL MEETING OF SHAREHOLDERS

: One year

| Content | Page | ||||

| General Information | 1 | ||||

| Your Proxy Vote | 2 | ||||

| How to Vote | 2 | ||||

| Voting Rules | 2 | ||||

| Proposals and Company Information | 4 | ||||

| 4 | |||||

| 9 | |||||

| 11 | |||||

| Corporate Governance | 13 | ||||

| Related Person Transactions | 15 | ||||

PROPOSAL NO. 2 - ADVISORY RESOLUTION TO APPROVE NAMED EXECUTIVE OFFICERS’ COMPENSATION | 16 | ||||

| 17 | |||||

| 38 | |||||

| 38 | |||||

| 39 | |||||

Security Ownership of Certain Beneficial Owners and Management | 40 | ||||

| 42 | |||||

PROPOSAL NO. 3 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 42 | ||||

| 42 | |||||

| 43 | |||||

| Other Matters | |||||

| 44 | |||||

Submitting Shareholder Proposals for the | 44 | ||||

| |||

| Appendix | 45 | ||

6, 2020.

the holders of a majority of such issued and outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. The Company, through bankers, brokers or other persons, also intends to make a solicitation of beneficial owners of Common Stock.

2020.

| 2020 Annual Meeting of Shareholders Notice & Proxy Statement | 1 | |||

| 1. | Via Internet: Go to |

| 2. | By Telephone: |

| 3. | By Mail: Request, complete and return a paper proxy card, following the instructions on your Notice. |

|

Corporate Secretary at or prior to the Annual Meeting that such Shareholder intends to vote in personduring the meeting or by submitting a subsequently dated proxy. Attendance atParticipation in the Annual Meeting by a Shareholder who has given a proxy shall not in and of itself constitute a revocation of such proxy.

| 2 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | Horace Mann Educators Corporation | |

2020.

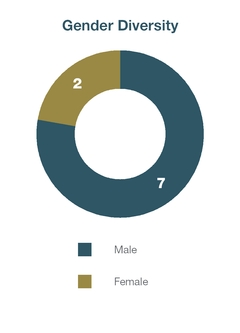

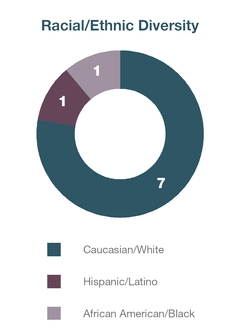

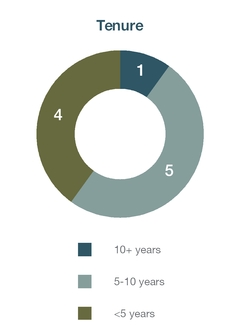

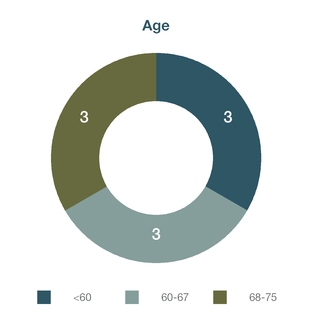

Election of Nine Directors specific finding by the Board that there are special circumstances to justify an exception, which supports Board refreshment. Since designations. Mr. Reece currently is a member of the Board of Directors of the North Carolina State University Foundation and the Blue Ridge Conservancy. Since Committees: Committees Horace Mann Proxy Statement 7 22, 2019. The Board recommends that Shareholders vote FOR the election of these nine nominees as Directors. The Chairman of the Board presides over all executive sessions of the Board, including executive sessions of non-employee Directors, and may be contacted as described in “Corporate Governance - Communications with ELECTION OF NINE DIRECTORSBy-LawsBylaws of the Company provide for the Company to have not less than five or more than fifteen15 Directors. The following nineten persons currently are serving as Directors of the Company (“Directors”): Mark S. Casady, Daniel A. Domenech, Mary H. Futrell, Stephen J. Hasenmiller, Ronald J. Helow,Perry G. Hines, Mark E. Konen, Beverley J. McClure, Gabriel L. Shaheen,H. Wade Reece, Robert Stricker, Steven O. Swyers and Marita Zuraitis. The terms of these Directors expire at the Annual Meeting. Dr. Futrell will be retiring fromMr. Hasenmiller, who has served on the Board as of the Annual Meeting, and the Board has nominated H. Wade Reece to serve as a new Director of the Company.for 15 years, is not standing for election. We thank Dr. FutrellMr. Hasenmiller for herhis exemplary service.Company’s Directors to possess a variety of qualities and skills. The Nominating & Governance Committee conducts all necessary and appropriate inquiries into the background and qualifications of Board candidates, including the determination of their independence. In addition, the Nominating & Governance Committee has identified areas of expertise that it believes support the Company’s business strategy in the short- and long-term, enable the Board to exercise its oversight function and contribute to a well-rounded Board.Financial Services Insurance Technology & Innovation Senior Leadership Experience Education or Niche Market Background Finance & Accounting Brand & Marketing Investments Agency Management Customer Experience Mark S. Casady X X X X X X X Daniel A. Domenech X X X Perry G. Hines X X X X X X Mark E. Konen X X X X X X X Beverley J. McClure X X X X X X X X H. Wade Reece X X X X X Robert Stricker X X X X Steven O. Swyers X X X X Marita Zuraitis X X X X X X X X X members’ qualifications as independent,consideration of experience, perspective, background, skill sets, age, ethnicity, and gender makeup of the current Board as well as considerationthe candidate’s individual qualities in leadership, character judgment and ethical standards. It also assesses the effectiveness of skills, experience, diversity and ageour interest in the context of the needs of the Board. diverse candidates.does not havebelieves our Board Nominees (as identified below) represent a formaldiverse base of perspectives and reflect the diversity policy; however,of the Company’s employees, customers and Shareholders, as well as an appropriate level of age and tenure, as further illustrated below.

the Nominating & Governance Committee believe that it is essential thatregularly consider the long-term makeup of the Board and how the members represent diverse viewpoints.of the Board change over time. The Board and Nominating & Governance Committee assessesunderstand the effectivenessimportance of Board refreshment and strive to balance the criteria described above when evaluating new Board candidates and when assessing the composition ofknowledge that comes from longer-term service on the Board aswith the new experience, ideas and energy that can come from adding directors to the Board. Directors who are 75 years of age or older may not stand for election in the absence of a whole.

4 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement Horace Mann Educators Corporation Hasenmiller,Hines, Mr. Helow,Konen, Ms. McClure, Mr. Reece, Mr. Shaheen, Mr. Stricker, Mr. Swyers and Ms. Zuraitis (the “Board Nominees”) to hold office as Directors. The proxies solicited by and on behalf of the Board will be voted “FOR” the election of the Board Nominees unless you specify otherwise. The Company has no reason to believe that any of the foregoing Board Nominees is not available to serve or will not serve if elected, although in the unexpected event that any such Board Nominee should become unavailable to serve as a Director, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated, or the Board may reduce the size of the Board. Each Director will serve until the next Annual Meeting of Shareholders and until his or her respective successor is duly elected and qualified.Board Nominees2016,2020, is provided with respect to each Board Nominee:

Age: 70Since:Since: 2015Committees:Customer ExperienceCommitteesTechnologyInvestment & Finance(“AASA”), The School Superintendents Association, a professional organization for educational leaders, since July 2008. He is currently Chairman of the Board of the Communities in Schools of Virginia and the National Student Clearinghouse Research Center and is a member of the Board of Directors of Learning First Alliance, America’s Promise, the Center for Naval Analyses, ACT and Universal Service Administrative Company, (“USAC”).where he Chairs the Schools and Libraries Committee. Dr. Domenech is also a past President of the New York State Council of School Superintendents, the Suffolk County Superintendents Association and the Suffolk County Organization for Promotion of Education, and was the first President and cofounderco-founder of the New York State Association for Bilingual Education. In addition, he has previously served on the U.S. Department of Education’s National Assessment Governing Board, on the Advisory Board for the Department of Defense schools, on the Board of Directors for the Baldrige Award and on the National Board for Professional Teaching Standards. Dr. Domenech has more than 40 years of experience in public education.2016Horace Mann Educators Corporation2020 Annual Meeting of Shareholders Notice & Proxy Statement • Proposals and Company Information35

Stephen J. HasenmillerAge: 66Since: 2004Committees:Compensation (Chair)ExecutiveNominatingCommitteesGovernanceFinanceHasenmillerHines is a retired corporate marketing executive and is the principal and owner of The Hines Group, LLC, a firm he formed in March 2001 after 242006 specializing in marketing, communications and strategic planning. He has over 27 years of service at The Hartford Financial Services Group, Inc.,cross-sector experience in general management, brand, communications and marketing. Mr. Hines previously served as Senior Vice President, - Personal Lines. Chief Marketing and Communications Officer for Irwin Mortgage Corporation, a position he held from 2002 to 2007, Senior Vice President, Chief Marketing and Sales Officer of Lincoln Reinsurance Corporation from 1998 to 2002 and Vice President of Marketing & Communications of Safeco from 1995 to 1998. He has held numerous management roles and stewarded well-known household brands. In addition to his consulting practice, he currently serves as the Director of Advancement for Covenant Christian High School.Hasenmiller’s prior affiliations include his tenureHines’ cross-sector expertise in general management, brand building and strategic marketing brings unique perspective and insight to the Board.

ChairmanPresident of the Personal Lines CommitteeInsurance and Retirement Solutions division, a position he had held since 2008. He was responsible for all aspects of strategic leadership, product development, and client services, as well as profitability management of the American Insurance Association (1999-2001)individual life insurance, group protection and membership onretirement plan services businesses. He oversaw Lincoln Financial Group’s individual life and annuity business as President, Individual Markets, from 2006 to 2008. Prior to its merger with Lincoln Financial Group in 2006, he served in various senior management positions with Jefferson Pilot Financial. Mr. Konen is currently a member of the BoardsBoard of Directors of the Institute for BusinessLincoln Life & Home Safety (1996-2001)Annuity Company of New York.the Insurance Institute for Highway Safety (1995-2001).Mr. Hasenmiller’s seasoned insurance backgroundproven leadership in the personal lineslife and retirement business including both direct sales and agency distribution, as well as his understanding and experience in dealing with complex insurance issues, provides the Board with a valuable perspective.

Ronald J. HelowAge: 71Director Since: 2009Horace Mann Committees:Customer Experience & Technology (Chair)AuditExecutiveMr. Helow is managing director of New Course Advisors, a consulting firm he founded in 2008 to advise companies on how to use advanced technologies to create a competitive advantage. Mr. Helow served from 2001 to 2008 as Partner and Chief Technology Officer at NxtStar Ventures, LLC, a firm providing consulting services to life insurance and retail financial services businesses, and founded Registry Systems Corporation in 1990 to custom design and implement mission critical projects using advanced computer technologies for insurance companies.Mr. Helow’s past experience in developing and securing solutions to insurance company operating challenges through technology brings to the Board unique knowledge and perspective.

Age: 61Since:Since: 2013Committees:AuditCompensationCustomer ExperienceCommitteesTechnologyGovernance35 year35-year career with United Services Automobile Association, (“USAA”),a diversified financial services group, as Senior Vice President, Enterprise Operations. She is owner ofIn 2007, she founded Fresh Perspectives LLC, a firm she founded in 2007 which specializes inan executive coaching and small business consulting.consulting firm, which was dissolved in 2019. Ms. McClure previously served as Senior Advisor of Endeavor Management, a consulting firm specializing in service culture creation, leadership coaching, business transformation, operational execution, and customer experience management, a position she held from 2010 to 2013. She holds the Chartered Life Underwriter and Fellow and Life Management Institute designations and is a certified executive coach through the International Coach Federation.perspective.perspective on these topics.420166 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement • Proposals and Company InformationHorace Mann Educators Corporation

Age: 59Board Nominee37 year37-year career with BB&T Corporation, (“BB&T”)a bank holding company, where he served as the Chairman of the Board and Chief Executive Officer of BB&T Insurance Services, Inc. and BB&T Insurance Holdings, Inc., the sixth largest insurance broker globally. Until his retirement in 2015, Mr. Reece served as Vice Chairman of the Foundation of Agency Management Excellence (“FAME”) Board of Directors and a member of the Executive Committee of The Institutes (American Institute for Chartered Property Casualty Underwriters and Insurance Institute of America). He was also a past Chairman of the Council of Insurance Agents & Brokers and past Chairman of the Board of Trustees of The Institutes.will provideprovides the Board with industry insight and perspective.

Gabriel L. ShaheenAge: 62Since: 2007Chairman Since: 2010Committees:Executive (Chair)Nominating & Governance (Chair)CompensationMr. Shaheen retired in 1999 after 22 years of service with Lincoln National Corporation, including service as President and Chief Executive Officer of Lincoln National Life Insurance Company, Managing Director of Lincoln UK, and President and Chief Executive Officer of Lincoln National Reinsurance Companies. Since 2000, he has been Chief Executive Officer of GLS Capital Ventures, LLC and Partner of NxtStar Ventures, LLC, firms providing consulting services to life insurance and retail financial services businesses. He is currently a member of the Board of Directors of M Financial Holdings Incorporated and Steel Dynamics, Inc., one of the largest steel producers and metals recyclers in the United States. Mr. Shaheen holds the Fellow of the Society of Actuaries designation.Mr. Shaheen’s insurance experience, technical insurance expertise and leadership background are valuable Board resources and contribute to Board discussion of issues impacting the Company.

Robert StrickerAge: 69Director Since: 2009Horace Mann Committees:AuditCustomer Experience & Technology2016 Proxy Statement • Proposals and Company Information

5

Age: 65Since:Since: 2014Committees:40 year40-year career with PricewaterhouseCoopers LLP (“PwC”), a public accounting firm. During this time with PwC, he served as the lead engagement partner on many national and international companies, including those in the financial services industry. He has also held various leadership positions at PwC, including leader of the Central Region’s consumer and industrial products business segment and managing partner of theirits St. Louis practice. He is currently a member of the Board of Directors of Mercy Health East Communities and Webster University. Mr. Swyers holds the Certified Public Accountant designation.

Marita ZuraitisAge: 55Director Since: 2013Committees:Customer ExperienceEducators Corporation2020 Annual Meeting of Shareholders Notice & Technology

2013. She joined2013 after joining the Company in May 2013 as President and Chief Executive Officer-Elect. Ms. Zuraitis joinedcame to Horace Mann from The Hanover Insurance Group where she was an Executive Vice President and a member of The Hanover’s Executive Leadership Team. From 2004 to 2013, she served as President, Property and Casualty Companies, responsible for the personal and commercial lines operations at Citizens Insurance Company of America, The Hanover Insurance Company and their affiliates.Group. Prior to 2004, Ms. Zuraitis was with The St. Paul/Travelers Companies for six years, where she achieved the position of President and Chief Executive Officer, Commercial Lines. She also held a number of increasingly responsible underwriting and field management positions with United States Fidelity and Guaranty Company and Aetna Life and Casualty. She is a member of the Board of Directors of LL Global, Inc., a trade association with operating divisions LIMRA and LOMA, and a memberincoming Chair of the Board of Trustees of The Institutes, the leading provider of risk management and property-casualty insurance education, whose offerings include the premier CPCU® designation. designation, and a past member of the Board of Directors of LL Global, Inc., a trade association with operating divisions LIMRA and LOMA. She is also a member of the Board of Directors of Citizens Financial Group, Inc. Ms. Zuraitis has over 30 years of experience in the insurance industry.20, 2015, with the exception of Mr. Reece, who was identified by a retained executive search firm working with the Directors of the Company and recommended for nomination as a Director by the Company’s Nominating and Governance Committee.nineten members on the Board as of March 15, 2016.2020. The Board met fiveeight times during 2015.2019. No Director of the Company attended fewer than 75% of the Board meetings and the committee meetings to which he or she was appointed and served during 2015.2019.Directors”.Directors.” The members of the Board are expected to be present at the Annual Meeting. The following nine Directors serving on the Board at the time of last year’s Annual

Meeting attended the meeting: Dr. Futrell,Domenech, Mr. Hasenmiller, Mr. Helow,Hines, Ms. McClure, Mr. Shaheen,Reece, Mr. Steinbecker,Shaheen, Mr. Stricker, Mr. Swyers and Ms. Zuraitis.

issues between Board meetings.

| 8 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | Horace Mann Educators Corporation | |

Analysis.”

The Committee does not have any specific, minimum qualifications that nominees must meet, but evaluates possible nominees to the Board on the basis of the factors it deems relevant, including the following:

high standards of personal character, conduct and integrity;

an understanding of the interests of the Company’s Shareholders, clients, employees, agents, suppliers, communities and the general public;

the intention and ability to act in the interest of all Shareholders;

a position of leadership and substantial accomplishment in his or her field of endeavor, which may include business, government or academia;

the ability to understand and exercise sound judgment on issues related to the goals of the Company;

a willingness and ability to devote the time and effort required to serve effectively on the Board, including preparation for and attendance at Board and committee meetings;

the absence of interests or affiliations that could give rise to a biased approach to directorship responsibilities and/or a conflict of interest, and the absence of any significant business relationship with the Company except for the employment relationship of an employee Director; and

the needs of the Board, including skills, experience, diversity and age.

TheCustomer Experience & Technology Committeeis an ad hoc committee formed by the Board during 2013. The Committee oversees the Company’s goals and strategies related to improving and managing the customer experience, as well as the development and implementation of the Company’s technology strategies.

| 2020 Annual Meeting of Shareholders Notice & Proxy Statement | ||||

| Director | Executive Committee | Compensation Committee | Nominating & Governance | Investment & Finance | Audit Committee |

Customer Technology | ||||||

Daniel A. Domenech | X | X | ||||||||||

Mary H. Futrell | X | X | X | |||||||||

Stephen J. Hasenmiller | X | Chair | X | |||||||||

Ronald J. Helow | X | X | Chair | |||||||||

Beverley J. McClure | X | X | X | |||||||||

Gabriel L. Shaheen | Chair | X | Chair | |||||||||

Robert Stricker | Chair | X | X | |||||||||

Steven O. Swyers | X | Chair | ||||||||||

Marita Zuraitis | X | X | X | |||||||||

Meetings in 2015 | 0 | 5 | 4 | 4 | 12 | 4 |

2019.

| Director | Executive Committee | Compensation Committee | Nominating & Governance Committee | Investment & Finance Committee | Audit Committee |

| Mark S. Casady | X | X | |||

| Daniel A. Domenech | X | ||||

| Stephen J. Hasenmiller | X | Chair | X | ||

| Perry G. Hines | X | X | |||

| Mark E. Konen | X | X | |||

| Beverley J. McClure | X | Chair | |||

| H. Wade Reece | Chair | X | X | ||

| Robert Stricker | Chair | ||||

| Steven O. Swyers | X | X | Chair | ||

| Marita Zuraitis | X | X | |||

| Meetings in 2019 | 1 | 5 | 4 | 4 | 12 |

| ||

| 10 2020 Annual Meeting of Shareholders Meeting Notice & | Horace Mann Educators Corporation | |

| Compensation Element | Non-Employee Director Compensation(1)(2) | ||

Board Chairman Annual Retainer | $ | ||

Board Member Annual Retainer | $ | ||

Committee Chairman Annual Retainer | $25,000 Audit Committee $15,000

| ||

| $10,000

| ||

Share-based Compensation | Fair value on the date of the respective awards is used to determine the number of Restricted Stock Units (“RSUs”) awarded. An annual award of All awards have a | ||

Basic Group Term Life Insurance | Premium for $10,000 face amount | ||

Business Travel Accident Insurance | Premium for $100,000 coverage | ||

|

|

|

(1) Annual retainer fees are paid following the Annual Shareholder Meeting each year. The annual retainer fees are prorated to the extent that a non-employee Director joins the Board after the Annual Shareholder Meeting.

| Director | Fees Earned in Cash ($) | Stock Awards ($) (1) | All Other Compensation ($) (2) | Total ($) | ||||||||||||

Daniel A. Domenech | 0 | 160,000 | 102 | 160,102 | ||||||||||||

Mary H. Futrell | 38,750 | 128,750 | 204 | 167,704 | ||||||||||||

Stephen J. Hasenmiller | 85,000 | 90,000 | 204 | 175,204 | ||||||||||||

Ronald J. Helow | 87,500 | 90,000 | 204 | 177,704 | ||||||||||||

Beverley J. McClure | 80,000 | 90,000 | 51 | 170,051 | ||||||||||||

Gabriel L. Shaheen | 129,500 | 90,000 | 51 | 219,551 | ||||||||||||

Robert Stricker | 82,500 | 90,000 | 204 | 172,704 | ||||||||||||

Steven O. Swyers | 87,500 | 90,000 | 204 | 177,704 | ||||||||||||

|

|

2019:

| Director | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | All Other Compensation ($) (2) | Total ($) |

| Mark S. Casady | 80,000 | 110,000 | 51 | 190,051 |

| Daniel A. Domenech | 70,000 | 110,000 | 204 | 180,204 |

| Stephen J. Hasenmiller | 85,000 | 110,000 | 204 | 195,204 |

| Perry G. Hines | 70,000 | 110,000 | 51 | 180,051 |

| Mark E. Konen | 70,000 | 110,000 | 51 | 180,051 |

| Beverley J. McClure | 85,000 | 110,000 | 51 | 195,051 |

| H. Wade Reece | 0 | 235,000 | 51 | 235,051 |

| Robert Stricker | 85,000 | 110,000 | 204 | 195,204 |

| Steven O. Swyers | 95,000 | 110,000 | 204 | 205,204 |

Director Independence

| 12 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | Horace Mann Educators Corporation | |

Throughout the year, the Board and the relevant Board committees receive regular reports from the Enterprise Risk ManagementERM Committee and its chairman regarding major risks and exposures facing the Company and the steps management has taken to monitor and control such risks and exposures. In addition, throughout the year, the Board and the relevant Board committees dedicate a portion of their meetings to review and discuss specific risk topics in greater detail.

Code of Ethics, Code of Conduct and Corporate Governance Principles

| Horace Mann Educators Corporation | 2020 Annual Meeting of Shareholders Notice & Proxy Statement 13 | |

In addition, a schedule is developed, with input from the Directors, which covers a broad range of topics to enhance and strengthen the skills, knowledge and competencies of Directors. Examples of such topics include cybersecurity, crisis management, regulatory developments, corporate governance and industry trends. The program encompasses presentations from internal and external speakers as well as site visits and regular meetings with management. Directors are also encouraged to avail themselves of educational programs offered through recognized independent providers.

| 14 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | Horace Mann Educators Corporation | |

Advisory Resolution to Approve Named Executive Officers’ Compensation

Analysis.”

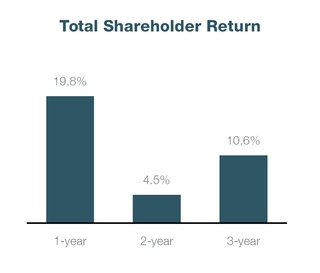

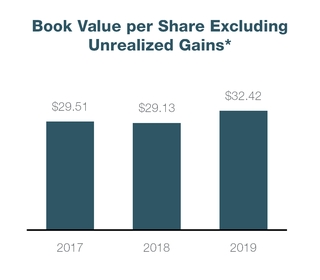

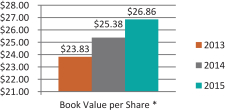

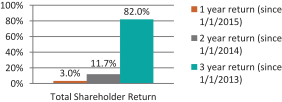

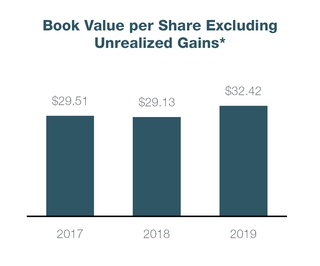

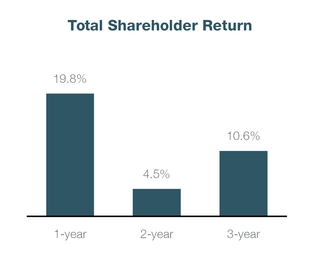

• $107 million in after-tax realized gains on assets transferred as consideration in the annuity reinsurance transaction. Core earnings of $92.2 million increased three-fold over prior year and core return on equity improved by five points. These results illustrated the potential of the company’s strategic initiatives as well as the three significant transactions completed during the year. Segment results included: its buyback authorization and continues to evaluate the potential for opportunistic buyback of shares. Since 2011, repurchases have totaled $77 million. executive benefits and aligned with Shareholders’ interests forms of plan design that effectively recognize favorable executive performance and experience, and ensure executive retention. For risk. Name Annualized Salary Annualized Salary Percent of 2015 Increase Reason For Increase Marita Zuraitis Dwayne D. Hallman Matthew P. Sharpe William J. Caldwell Kelly J. Stacy Plan 2013-2015 Performance Measures (1) Measurement Weighting 2013-2015 Performance Period Targets 2013-2015 Performance Period Results 2013-2015 Performance Period Weighted Absolute vs. Relative Operating Earnings per Share Growth Operating Return on Equity Total Shareholder Return Total 2015-2017 Performance Measures (1) Measurement Weighting 2015-2017 Performance Period Targets Absolute vs. Relative Operating Return on Equity Total Shareholder Return Total Written Premium Growth Total Opportunity Name Target in 2014 Target in 2015 Marita Zuraitis Dwayne D. Hallman Matthew P. Sharpe William J. Caldwell Kelly J. Stacy the measurement period (12/31/19). Source: S&P Market Intelligence 2015 Stock Ownership 2015 Book Value (1) Marita Zuraitis Dwayne D. Hallman Matthew P. Sharpe William J. Caldwell Kelly J. Stacy 2015 Target AIP Opportunity 2015 Actual AIP Paid 2015 Actual AIP Paid as a Percent of Salary Marita Zuraitis Dwayne D. Hallman Matthew P. Sharpe William J. Caldwell Kelly J. Stacy Annual 2015 Corporate Measures (1) Measurement Weighting Actual Weighted Results Absolute vs. Relative Adjusted Operating Income P&C Net Premium Written Horace Mann Annuity Sales Horace Mann Life Sales Total Retirement PlansIn this section, we describe the material components of our executive compensation program for our Named Executive Officers, or “NEOs,” whose compensation is displayed in the 2015 Summary Compensation Table and the other compensation tables contained in this Proxy Statement. We also provide an overview of our executive compensation philosophy and we explain how and why the Compensation Committee (the “Committee”) arrives at specific compensation policies and decisions.Our 2015 NEOs are our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three other most highly compensated Executive Officers employed at the end of 2015:Marita Zuraitis, President and Chief Executive Officer;Dwayne D. Hallman, Executive Vice President and Chief Financial Officer;Matthew P. Sharpe, Executive Vice President, Annuity and Life;Casualty;Life & Retirement; andKelly J. Stacy, Senior Vice President, Field Operations and Distribution.We are$10.1$12.5 billion of assets and approximately $1.4 billion in total revenue as of December 31, 2015.2019. Founded by Educators for Educators®, we offer ourthe Company offers products and services primarily to K-12 teachers, administrators, and other employees of public schoolsschool employees and their families. We underwriteHorace Mann underwrites personal lines of auto, property, life and lifesupplemental insurance, andas well as retirement annuitiesproducts in the United StatesStates.America.2015 Business HighlightsCompany delivered solidProperty and Casualty combined ratio of 96.5% reflected a 4.0-point improvement in the underlying financialauto loss ratio as well as catastrophe losses well below 2018, when results across all three segmentsincluded $38 million in catastrophe costs from the Camp Fire;its multiline insurance platformthe Supplemental business provided important diversification to revenue and earnings, adding $18.0 million to core earnings in 2015. Full year Operating Income was $2.00 per diluted share. the second half of 2019.16 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement Horace Mann Educators Corporation 6%11% in 2015 driven by2019, primarily reflecting the solid operating results and positive contributions from investment portfolio performance. In addition, broad-based increasesrealized gain on assets transferred in new business sales and solid policy retentions were achieved during the past year.annuity reinsurance transaction, as well as strong earnings. Total Shareholder Return was 3.0%19.8% in 2015.

*Excluding the fair value adjustment for investmentsThese results reflect significant progress2019, under-performing property and casualty and life insurance indices.

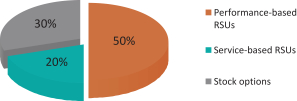

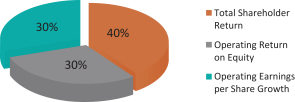

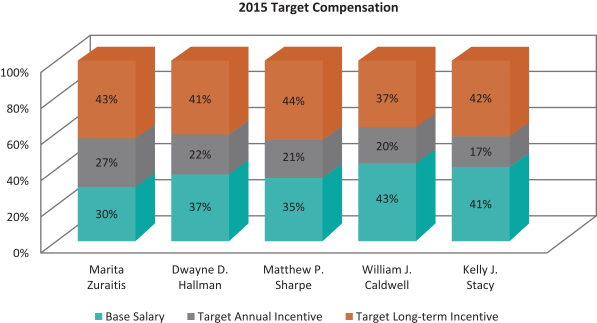

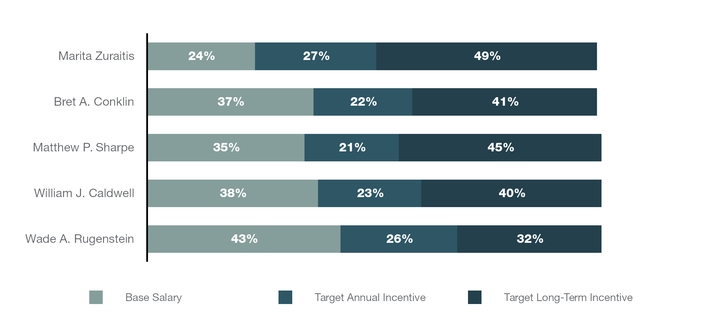

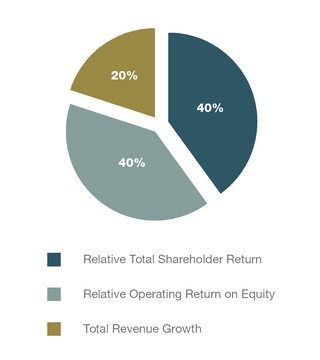

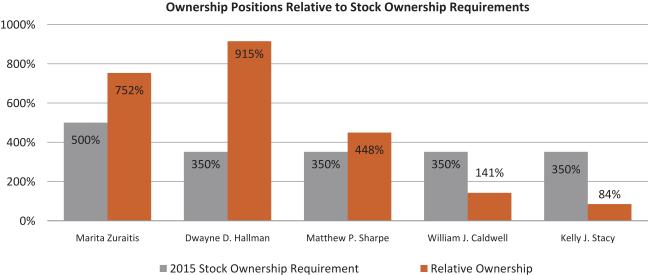

numerous strategic initiatives, including:•Increased sales levels year-over-year in all lines of business excluding life•New auto sales premium increased 7%•Auto policy-in-force growth of 1.2%•Horace Mann agency annuity sales increased 8% including the new fixed indexed annuity product•Strong auto and property retention ratios•Improved profitability in the underlying Property and Casualty book of business•Increased annuity assets under management by 5%•Introduction of new indexed universal life product20152019 Annual Report on Form 10-K for a more detailed description of these financial results.2016Horace Mann Educators Corporation2020 Annual Meeting of Shareholders Notice & Proxy Statement • Compensation Discussion and Analysis1117Practicemix comprised of base salary, cash annual incentives under the Annual Incentive Plan (“AIP”), and Governanceequity-based long-term incentives under the Long-term Incentive Plan (“LTIP”)• Balanced pay mix comprised of Base Salary, Long-term Equity Incentive Awards, and Annual Cash Incentives• Over 70% of the CEO’s target compensation and over 56% of all other NEOs’ target compensation is linked to performance and service-based incentives and is at risk• Balanced performance–Performance-based RSUs vest following a 3-year period, based on relative measures designed with a focus on(relative total shareholder return and incenting profitable growth while managing risk• Performance incentives tied to multiple overlapping performance periods• Annual Incentive Plan tied to absolute performance measures• Long-term Incentive Plan had been tied to all relative performance measures until the introduction ofoperating return on equity) and an absolute total revenue growth measure in 2015• Long-term Incentives are entirely equity basedØ Service-based– Service-vested stock options with a 4-year vesting period Ø Performance-based RSUs vest following a 3-year performance periodØ Service-based– Service-vested RSUs with a 3-year vesting period • Stock Ownership Requirements for NEOs (500% of salary for CEO, 350% of salary for other NEOs) and a 12-month– Twelve-month post-exercise holding requirement onfor stock options• Clawback Policy applicable to both cash and equity awards• Executive Change in Control Plan excludes “tax gross-up” provisionsPay PracticeStrong Pay for PerformanceWe target compensation around the median of the competitive market, with executives earning more or less than median based on the performance of the Company and value delivered to Shareholders. The overall executive compensation program includes base salary, long-term equity awards and annual cash incentives. Incentive awards are earned upon the achievement of short-term and long-term business goals that are reviewed and approved by the Committee at the beginning of each performance period. Performance goals are structured to reward for business growth and profitability, balanced with productivity and risk and capital management.Long-term Incentive PlanOur Long-term Incentive is comprised of three vehicles, performance-based RSUs, service-based RSUs and stock options, as described below. The performance-based RSUs provide an effective vehicle for rewarding executives based on a three-year performance period and have a high value in promoting executive retention. The performance-based RSUs, along with the service-based RSUs and stock options provide strong alignment with Shareholder interests and assist in the retention of key executive talent.Long-term Incentive Vehicles

Performance-based RSUs - Earned over a three-year period, based upon Relative and Absolute Measures. If any shares are earned at the end of the three-year performance period, the executive fully vests in the awardService-based RSUs - Vest 1/3 per year after years 1, 2 and 3Stock options - Granted at fair market value with a 10 year life; options vest ratably over 4 years122016 Proxy Statement • Compensation Discussion and AnalysisLong-term Incentive Plan Performance-based MeasuresOur Long-term Incentive performance-based measures cover a three year period. Each year, a new three year period starts, partially overlapping the periods that started the prior two years. The Committee may alter the performance measures as any new three year period starts. The performance measures adopted have been:2013-2015 Performance-based RSU Measures

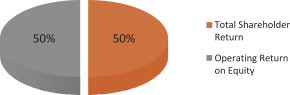

Total Shareholder Return - Relates to the Total Shareholder Return for the three-year period measured against a peer group of companiesOperating Return on Equity - Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companiesOperating Earnings per Share Growth - Relates to the total percentage increase or decrease in Operating Earnings per share for the three-year period measured against a peer group of companies2014-2016 Performance-based RSU Measures

Total Shareholder Return - Relates to the Total Shareholder Return for the three-year period measured against a peer group of companiesOperating Return on Equity - Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companies2015-2017 Performance-based RSU Measures

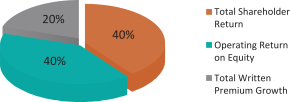

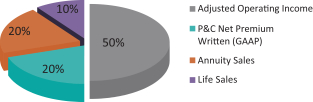

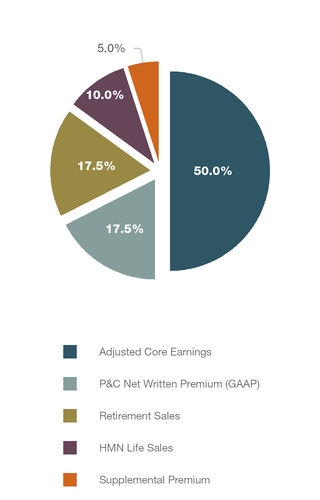

Total Shareholder Return - Relates to the Total Shareholder Return for the three-year period measured against a peer group of companiesOperating Return on Equity - Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companiesTotal Written Premium Growth - Relates to Horace Mann written premium growth measured as the compound annual growth rate from 2014 to 2017 for Auto, Property, Annuity and Life.These three measures for the 2015-2017 period focus on the effective use of capitaldelivering on growth objectives while retaining our strong alignment with Shareholder interests.Annual Incentive PlanThe Annual Incentive performance measures provide balance between Shareholder return (operating income - 50%)equity awardsgrowth (sales and revenues - 50%). Further, these measures were designed to complement the metrics of the Long-term Incentive which focus on long-term shareholder value creation. The performance measures correspond to our financial plan (“Plan”) objectives approved by the Committee. The Annual Incentive is paid in cash.2015 Annual Incentive Performance Measures

Adjusted Operating Income - Operating income (GAAP net income after tax, excluding realized investment gains and losses other than those for FIA related options and embedded derivatives) adjusted for Property & Casualty (“P&C”) catastrophe costs different than Plan, Annuity & Life deferred acquisition costs (“DAC”) unlocking and change in guaranteed minimum death benefit (“GMDB”) reserve due to capital gains and losses and market performance different than Plan, the impact on investment income of share repurchases different than Plan, and debt structure/costs including debt retirement different than PlanP&C Net Premium Written (GAAP) - Amount charged for property and casualty policies issued during the year; portions of such amounts may be earned and included in financial reports over future periodsAnnuity Sales - The amount of new business from the sales of Horace Mann annuity products, from Horace Mann and independent agents, as measured by premiums and deposits to be collected over the 12 months following the saleLife Sales - The amount of new Horace Mann individual life insurance products sold during the year, as measured by premiums and deposits to be collected over the 12 months following the sale2016 Proxy Statement • Compensation Discussion and Analysis13Committee theour executive compensation program for our NEOs.program. The compensation program is designed to provide a direct and clear link between the performancecurrent members of the CompanyCommittee are Mr. Hasenmiller, Mr. Konen, Ms. McClure, and executive pay. To assist inMr. Reece. Mr. Hasenmiller serves as the constructCommittee Chair. Consistent with the listing standards of the compensation program design,NYSE, the assessmentCommittee is composed entirely of the program’s relevance to current market trends and the analysis of the program’s effectiveness, theindependent Directors.consultants who report directly to the Committee.consultants. CAP attends Committee meetings, including portions of executive sessions, and serves solely at the pleasure of the Committee.As will be discussed in more detail in next year’s proxy statement, in March 2016, the Company made performance-based Restricted Stock Unit (RSUs) grants to key executives, including the NEOs, under our 2010 Comprehensive Executive Compensation Plan (as amended and restated effective May 20, 2015) (“CECP”). All such grants are subject to satisfaction of certain objective threshold company-wide performance standards. The Company’s success makes our leadership team more vulnerable to recruitment by competitors. The Committee believes the grants promote continuity and retention of our strong leadership team as we pursue our aggressive 20/20 Vision, and also strengthen management’s alignment with Shareholder interests.In addition, the Committee believes its oversight of executive compensation is strongly enhanced by the on-going education of each Committee member on emerging legislation, regulatory guidelines and industry best practices. This is done through review of topical publications, participation in webcasts, attendance at seminars and conferences on executive compensation and formal updates by CAP and other external experts during Committee meetings. Committee members provide management and CAP with topics for presentation and discussion prior to each meeting. During the Committee meetings, Committee members, the Board’s outside legal counsel, management and CAP discuss executive compensation, benefits and related issues and their relevancy to the Company, its Shareholders and its executive compensation program. The Committee has an executive session, without management present, during each of its meetings.Stock Ownership & Holding RequirementsThe Company’s Long-term Incentive Plan has been 100% equity-based since 2009. The equity iscomprised of a combination of stock options, performance-based RSUs and service-based RSUs.Paying these incentives solely in equity-based instruments and requiring executives to meetspecific stock ownership requirements further serves to align our executives’ and Shareholders’interests. As part of its 2015 overall review of the executive compensation program, theCommittee determined the existing multiples of base salary stock ownership requirements for theExecutive Officers were appropriate and would be continued in 2016. The CEO is required toaccumulate and maintain beneficial stock ownership with a book value of at least 500% of basesalary and all other NEOs to accumulate and maintain beneficial stock ownership with a bookvalue of at least 350% of base salary. Currently, our NEOs are required to satisfy stock ownershipStock OwnershipRequirements (1)CEO500%All other NEOs350%(1) Percentage of base salarylevels within five years of attaining their position. Beginning with the March 9, 2011 stock option grants, the NEOs are required to hold shares equivalent to any proceeds from a long-term incentive stock option exercise, net of exercise price and related taxes and the costs of the exercise, for a minimum of twelve months after the date of exercise. All NEOs have met or are on target to meet the stock ownership requirements.Annual Performance & Pay ReviewTo further reinforce the tie between Company results and compensation, each executive officer’s performance is reviewed by the Committee every 12 months, coinciding with the review of corporate performance results. Each executive officer is reviewed not only on prior year business results but also on the individual’s demonstration of leadership skills and progress on specific strategic initiatives and other key priorities. The Committee also considers any adjustments to base salary, long-term incentive opportunity and annual incentive opportunity at this review.The Committee recognizes the need to have market-competitive compensation opportunities to attract, retain, and reward high performing executive talent. CAP reviews our executive compensation and compensation practices relative to the competitive market. Overall, our total target compensation is comparable to the market median, with above-target performance allowing for the possibility of total compensation greater than market median and below-target performance resulting in total compensation below market median.Risk AssessmentOur programs are structured to discourage excessive risk-taking through a balanced use of compensation vehicles and metrics with an overall goal of delivering sustained long-term shareholder value while aligning our executives’ interests with those of our Shareholders. To this end, management and CAP conduct, and the Committee and the Board’s outside legal counsel reviews, an annual risk analysis of the compensation plans and incentive metrics. Our programs require that a substantial portion of each executive officer’s compensation be contingent on delivering performance results that benefit our Shareholders. In addition, a significant portion of our NEOs’ compensation is delivered in equity over a multi-year timeframe and each executive is expected to satisfy meaningful stock ownership requirements as well as comply with holding requirements. Furthermore, incentive compensation is subject to clawbacks. Similarly, we have stock ownership requirements for our non-employee Directors which are described under “Director Compensation.” The Committee has been advised by the Board’s outside legal counsel and agrees that no unreasonable risk exists that a compensation policy or incentive plan would have a material adverse impact on the Company.142016 Proxy Statement • Compensation Discussion and AnalysisSuccession Planning ProcessTo further mitigate enterprise risk and ensure the Company does not suffer sustained gaps in leadership, the Committee approves, oversees and monitors the Company’s succession planning process. This process identifies candidates that have the skill sets, background, training, and industry knowledge to assume critical positions on an emergency basis and also for the long-term executive succession plan. The Company’s succession plan is reviewed by the full Board annually.Minimal Use of Employment AgreementsAs of the time of this Proxy Statement, the Company did not have any individual employment agreements with any executive and intends to continue to minimize their use, while recognizing that in isolated situations they may be needed for attraction and retention of key executive talent.Change in Control and Elimination of Prospective Gross-upsFour of the NEOs are covered under the Horace Mann Service Corporation Executive Change in Control Plan (“Executive CIC Plan”). This plan provides “double trigger” benefits and does not contain a tax gross-up provision. The Company does have an individual change in control severance agreement with Mr. Hallman, which provides severance pay, including a “parachute tax” gross-up payment, in the event of an actual or constructive termination of employment within a fixed time after a change in control of the Company, as defined in the agreement (a “double trigger”). The Committee has determined that, while it cannot change unilaterally any existing change in control severance agreements with current executives, it does not plan to include tax gross-up provisions in any future agreements.ClawbacksThe Committee further believes that our compensation program should reward performance that supports the Company’s culture of integrity through compliance with applicable laws and regulations and our codes of ethics and conduct. As a further step to support that belief, the Committee has determined that all executive officers are subject to the same standards as the CEO and CFO regarding cash compensation clawbacks as defined under Section 404 of the Sarbanes-Oxley Act of 2002. In addition, under the CECP, the Company has the right to recover any cash or equity award if it is determined that an executive’s own misconduct contributed materially to the executive’s receipt of an award. New guidance under the Dodd-Frank Act related to clawbacks has been proposed by the Securities and Exchange Commission and the Company will modify the current clawback provisions to comply with the guidance when finalized.Favorable Say on PayAt our 2015 Annual Meeting of Shareholders, we received substantial support for the compensation of our NEOs, with 97.27% of the votes cast in favor of the “Say on Pay” advisory vote on executive compensation. The Compensation Committee and the Board appreciate and value the views of our Shareholders. In considering the results of this advisory vote, the Compensation Committee was pleased that a significant majority of our Shareholders approved the proposal, showing strong support for the structure of the compensation plans, the absence of excessive perquisites, the demonstrated pay-for-performance practices and the strength of the Company’s compensation processes and practices.Hedging ProhibitionNEOs and other executive officers are prohibited from engaging in hedging transactions in HMEC common stock.Pledging ProhibitionBeginning in 2013, NEOs and other executive officers have been prohibited from pledging their HMEC common stock shares.Perquisites and Personal BenefitsWe provide limited perquisites, which are commonly provided among our peer companies. Please see the “Summary Compensation Table” for further details.2016 Proxy Statement • Compensation Discussion and Analysis15Executive Compensation ProgramOversightThe Committee oversees our executive compensation program. The current members of the Committee are Dr. Futrell, Mr. Hasenmiller, Ms. McClure, and Mr. Shaheen. Mr. Hasenmiller serves as the Committee Chair. Consistent with the listing standards of the NYSE, the Committee is composed entirely of independent Directors.The Compensation Committee is composed entirely of independent Directors.The Committee has retained CAP to provide information and advice on the competitive market for executive talent, evolving market practices in our industry and the general employment market, regulatory and other external developments, and our executive compensation philosophy and incentive program design. In this way, CAP assists the Committee with ongoing education. Also, Committee members comply with Directors’ education requirements to help ensure each remains up to date on current issues relevant to the Company and its business.and serve(generally with the Board’s outside legal counsel, but without management present). CAP serves at the pleasure of the Committee. CAPCommittee, and performs no other services for management or the Committee.related to executive compensation. CAP works with management to obtain necessary data and perspectives on the Company’s strategic objectives, business environment, corporate culture, performance, and other areas.relevant factors. This information is used by CAP to formulate its recommendations related to competitive compensation performance targets and overall design. CAP’s findings and recommendations are reported directly to the Committee. The services provided by CAP during 20152019 are described in more detail throughout this analysis. Pursuant to regulatory requirements, the Committee has 18 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement Horace Mann Educators Corporation reviewedwelcomes the opportunity to provide additional insight into our executive compensation practices and appreciates the positive support from our Shareholders. We continue to believe that the overall structure of our compensation plans, the absence of excessive perquisites, and our demonstrated pay-for-performance practices reflect the strength of the Company’s executive compensation programs.and compensation of specified Long-term Incentive Plan (“LTI”) participants on a common review date concurrent with the annual review of the prior year’s performanceCompany and value delivered to Shareholders. Our core executive compensation program includes base salary, an annual cash incentive plan (“AIP”), and long-term equity awards (“LTIP”). Both AIP and LTIP are administered under the incentive plans.Guiding PrinciplesThe Committee has established the following core principles that underlie our executive compensation program:• Executive interests should be aligned with Shareholders;•Shareholder-approved 2010 Comprehensive Executive Compensation Plan, as amended (“CECP”). Incentive awards are earned upon the achievement of short-term and long-term business goals that are reviewed and approved by the Committee at the beginning of each performance period. Performance goals are structured to reward business growth, profitability, relative total shareholder return, balanced with productivity and risk and capital management. be structured to drive long-term value creation and reward strong performance;• A significant portion of compensation should be “at risk” based on the Company’s performance; and• Compensation levels should be market competitive.Executive interests should be aligned with ShareholdersOur incentive plans facilitate stock ownership and include performance measures that drive long-term sustained shareholder value. The Company grants equity awards with multi-year performance periods to reward sustained performance and multi-year vesting to encourage retention. We allow deferrals of RSU awards and our executives are also required to satisfy meaningful stock ownership requirements. In 2015 through the Long-term Incentive Plan, we delivered approximately 43% of Ms. Zuraitis’s compensation in equity. With respect to the other NEOs, approximately 37% to 44% of their compensation was delivered in equity.Incentive compensation should be structured to drive long-term value creation and reward strong performanceOur executive compensation program includes significant equity-basedcash-based incentives intended toadjusted operating income which drive long-term value and short-termare metrics management can control. The LTIP performance goals are directly linked to multi-year growth and return measures to keep executives focused on value creation. The Long-term Incentive Plan delivers 50% of the long-term incentive opportunities in performance-based and 50% in service-based equity awards. The minimum vesting period for any equity award is three years and the maximum is four years. The Annual Incentive is solely performance-based and paid in cash.creation, with multiple metrics based on performance versus peers to focus on outperforming our peers.16Horace Mann Educators Corporation20162020 Annual Meeting of Shareholders Notice & Proxy Statement • Compensation Discussion and Analysis19A significantOver 70% of the CEO’s targettotal pay is at risk and over56% of target total pay for allother NEOs is at risk.Generally, over 70% of the CEO’s target total pay and over 56% of target total pay for all otherNEOs (base salary plus target annual incentive plus target long-term incentive) is at risk, isvariable from year to year, and demonstrates a strong link between pay and performance. Tofurther enhance the pay-for-performance linkage, we incorporate performance relative tocomparable companies into our long-term incentive measures.believessets total direct compensation for the NEOs – salary and target annual and long-term incentive opportunities – within a reasonable range of the median of the competitive market, while providing the ability to decrease or increase compensation programif warranted by performance and experience. To determine competitive pay levels, we use an established peer group of similarly sized insurance companies in the Russell 3000® Index. The Committee worked with CAP to select our peer insurance companies for 2019 (noted below), based upon assets under management and revenue. The peer group does not include reinsurance or insurance brokers. We supplement this information with survey market data from published sources including Equilar, Towers Watson, and Korn Ferry. The data from these surveys is critical in attracting and retaining top executives. Consequently, when making compensation decisions,scaled to our size by CAP based on revenues or asset ranges. Annually, CAP provides the Committee considerswith a comparison of the compensation opportunities providedbase salary, annual incentives and long-term incentives of the CEO with those of other Chief Executive Officers based on the peer group and survey data obtained. For 2020, the peer group will be updated to similarly situated executives at comparable companiesremove Navigators Group, Inc. and MBIA, Inc. as well as howto add ProAssurance Corporation.is delivered (e.g., short-term vs. long-termat any specific level relative to the peer group. Instead, the Committee uses this information primarily as a general reference point to determine pay levels and fixed vs. variable).Assessing Compensation CompetitivenessThe Committee intends to set total direct compensation for the NEOs – salary and target annual and long-term incentive opportunities – within a reasonable range of the median of the competitive market, while providing the opportunity for additional compensation if warranted by performance. To determine competitive pay levels, we use comparable survey market data provided by our independent consultant, CAP,and from published survey sources including LOMA, Towers Watson, and proxy data for similar sized insurance companies in the Russell 2000® Index. The data from these surveys is scaled to our size by CAP based on revenues or asset ranges as provided by the various surveys. The NEOs are assessed against comparable functional matches in the insurance industry and the broader general industry, as appropriate.Every year, CAP provides the Committee with a comparison of the base salary, annual incentives and long-term incentives of the CEO with those of other chief executive officers based on survey data. Based on the data, CAP2015 Consultant Survey Sources• LOMA: Executive Compensation Survey• Towers Watson: Top Management Compensation Survey• Proxy Data for Insurance companies in the Russell 2000® Indexmakes recommendations for CEO compensation for the Committee’s consideration. The Committee then deliberates in executive session to determine its recommendation for approval by the Board of Directors.2015, the CAP2019, CAP’s analysis demonstrated that the average of 2015overall core total direct compensation for Ms. Zuraitis was consistent with target pay positioning at the median of the market. This is consistent withBased on the Committee’s compensation philosophy.2016 Proxy Statement • Compensation Discussion and Analysis2019 Peer GroupAmbac Financial Group, Inc. Kemper Corporation Primerica, Inc. American Equity Investment Life Holding Co MBIA, Inc. RLI Corporation Argo Group International Holdings, Ltd. National General Holdings Corporation Selective Insurance Group, Inc. CNO Financial Group, Inc. National Western Life Group, Inc. State Auto Financial Corporation Employers Holdings, Inc. Navigators Group, Inc. United Fire Group, Inc. FBL Financial Group, Inc. 1720 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement Horace Mann Educators Corporation We structure our executiveprogram to deliver the majorityconsists of pay through incentives driving both operating resultsbase salary, annual and long-term value and positioning more than half of each NEO’s pay at risk.incentives. The targeted compensation mix of total direct compensation for the NEOs at the beginning of 2015for 2019 is illustrated below. The mix of 20152019 actual compensation varied as a result of actual incentives earned.

industry salaries for executives of similar companies in like positions. In order to determine competitive positioning, the Committee requests CAP to assess compensation for the CEO and the four other NEOs. CAP makes their comparisons based on industry norms, represented by survey compensation for comparable positions in the insurance industry and general industry, and this information is used as a reference point for the Committee. However, in recruiting new executives, we vary from these guidelines are sometimes exceeded to attract qualified candidates. There may also be instances wheredesired talent. Additionally, an existing executive’s compensation deviatesmay deviate from the median either up or down, due to experience, performance, responsibilities, compensation history, internal equity, and/or retention risk with no pre-determined goals assigned to such considerations.Executive Officersthe NEOs and other executive officers are reviewed every 12 months in connection with the review of financial results for the prior fiscal year.year and the annual performance review discussed under “Annual Performance and Pay Review” below. In 2019, Ms. Zuraitis, Mr. Conklin and Mr. Caldwell received base salary increases to move overall compensation closer to the market median. Mr. Sharpe did not receive a base salary increase in 2019. In addition, to considering market data,Mr. Rugenstein joined the Committee reviews each executive’s performance, includingcompany in July 2019 as part of the accomplishmentacquisition of key corporate, strategic, operational, financial and management goals, and upholding our standards of ethical conduct. 2014 2015 $704,000 $750,000 6.53% (1) $444,000 $444,000 0% $364,000 $400,000 9.89% (2) $300,000 $350,000 16.67% (3) N/A $300,000 N/A (4) N/A – Not applicableNamed Individual

Annualized

Salary

Annualized

SalaryPercent

IncreaseMarita Zuraitis 900,000 930,000 3.3% Bret A. Conklin 350,000 400,000 14.3% Matthew P. Sharpe 425,000 425,000 0.0% William J. Caldwell 385,000 400,000 3.9% Wade A. Rugenstein N/A 400,000 N/A (1)Ms. Zuraitis’ adjustment was made to move her overall compensation closer to the market median(2)Salary adjustment was made based on Mr. Sharpe’s performance in 2014, specifically in product development and annuity sales, and to move his overall compensation closer to the market median(3)Salary adjustment reflects Mr. Caldwell increased role and responsibilities due to his promotion to EVP, Property & Casualty(4)New Hire in 201518Horace Mann Educators Corporation20162020 Annual Meeting of Shareholders Notice & Proxy Statement • Compensation Discussion and Analysis21Long-termThe Company awards long-term incentivesNEOsdrive and other executives who can havereward strong performance over a one-year period. Annually, the greatest impact onCommittee establishes the Company’s long-term success. Long-term incentivesperformance objectives, threshold, target and maximum performance levels, and the related threshold, target and maximum AIP opportunities for each NEO, expressed as a percentage of base salary. Target incentive opportunity levels for the NEOs are intended to approximate the median of the target bonus potential for similarly situated executives in comparable companies. Maximum incentive opportunities are set at 200% of target.executives on drivinglong-term shareholder value creation. For 2020, the performance measures will include an additional focus on Return on Equity.

22 2020 Annual Meeting of Shareholders Meeting Notice & Proxy Statement Horace Mann Educators Corporation performanceincome and sales or premium measures were based on a review of market conditions and expectations of other companies in the industry as well as long-termour financial plan for 2019 (“2019 Plan”). The 2019 Plan was the basis of our 2019 earnings guidance, which was publicly disclosed in February 2019 in connection with the announcement of results for the year ended December 31, 2018. The Committee believes that tying the AIP to overall Company performance provides appropriate alignment for an executive’s compensation as it recognizes that the Company as a whole must perform well in order to deliver value creation. They are also an effective vehicle for attracting and retaining executive talent. All long-term incentive grants are made underto our Shareholders. It is the Company’s CECP. As discussed previously, the Company’s Long-term Incentive Plan is comprisedgoal of three vehicles, performance-based RSUs, service-based RSUs and stock options.

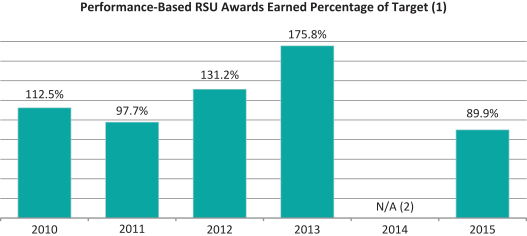

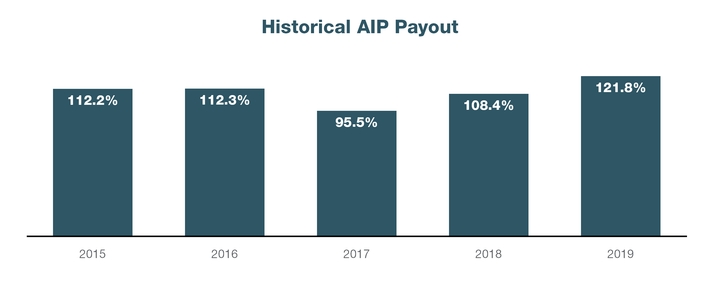

N/A – Not applicable(1)Graph represents percent of target performance-based awards earned in the year the long-term incentive measurement period ended. Performance-based RSUs comprise 45-50% of the total long-term incentive opportunity.(2)Due to the Company adopting a three-year performance period in 2013, the performance period ended in 2015 and no long-term period ended in 2014.In setting targets for performance-based RSUs under the Long-term Incentive Plan, the Committee considers, amongto establish measurements and targets that are reasonable, but not easily achieved. The measures and targets are discussed with the CEO, other things, the external competitive and financial markets environment, the strategic goalsNEOs, other members of the Company, internal financial projections,Board and CAP before they are set.difficultyCommittee certifies performance and determines AIP payouts for the prior year. Based on the 2019 results of meeting those goals and projections. For the five most recently completed performance periods, awards earned under the Long-term Incentive Plan have ranged from approximately 90% to 176% of target, with an annual average of 121.4%121.8% of target for Ms. Zuraitis and the performance periods,other NEOs, the 2019 AIP payouts (paid in March 2020) were as illustrated in the graph above.The variability and average level of the awards earned confirms the Committee’s practice of establishing reasonable yet aggressive goals for the Company’s follows:2019 AIP Measures (in $M) Threshold Target Maximum Actual Results Weighting Payout Adjusted Core Earnings (Jan-Jun) 36.6 39.4 43.5 44.2 200.0% 25% 50.0% Adjusted Core Earnings (Jul-Dec) 52.3 56.2 62.1 60.5 174.0% 25% 43.4% P&C Net Premium Written 692.2 702.7 716.8 683.1 0.0% 17.5% 0.0% Retirement Sales 619.1 631.7 657.0 643.8 148.0% 17.5% 25.9% Horace Mann Life Sales 22.2 23.2 24.3 17.7 0.0% 10% 0.0% Supplemental Premium 65.7 66.7 67.0 65.7 50.0% 5% 2.5% Total 100% 121.8% Named Individual 2019 Target

AIP Opportunity2019 Actual AIP Payout

as a % of Base SalaryMarita Zuraitis 115% 1,295,542 139.3% Bret A. Conklin 60% 286,207 71.6% Matthew P. Sharpe 60% 310,564 73.1% William J. Caldwell 60% 290,469 72.6% Wade A. Rugenstein 60% 38.7%

Horace Mann Educators Corporation 2020 Annual Meeting of Shareholders Notice & Proxy Statement 23 Plan.the programour LTIP is to focus executives on shareholderShareholder value and key strategic objectives, while promoting retention and recognizing the market trend to deliver long-term incentives through a mix of equity-based compensation vehicles. Further, in combination with the cash component of the Annual Incentive Plan (“AIP”), the compensation program provides a meaningful incentive without encouraging excessive risk taking. To ensure that our executives’ interests are aligned with those of our Shareholders, our executives are required to defer earned and vested RSU awards until their stock ownership requirements are met.2016 Proxy Statement • Compensation Discussion and Analysis19Long-term Incentive Plan Design andretention. Setting2013-2015 Long-term Incentive Plan Grants and AwardsThe 2013 awards were 100% equity-based and were comprised of 50% performance-based RSUs, 20% service-based RSUs and 30% service-based stock options. All measures were defined as relative, specified performance levels measured against a peer group of companies. The peer group of companies was made up of all insurance companies included in the Russell 2000® Index, except for brokerages, reinsurance, financial guarantee and health companies. The performance measures and targets for the performance-based RSUs were as follows:

Results 30 % 50th Percentile of Peer Group Below Threshold 0.00 % Relative 30 % 50th Percentile of Peer Group 59th Percentile of Peer Group 36.90 % Relative 40 % 50th Percentile of Peer Group 63rd Percentile of Peer Group 53.06 % Relative 100 % 89.96 % (1)The Performance Measures, as defined under the Long-term Incentive Plan, include:•Operating Earnings per Share Growth – Relates to the total percentage increase or decrease in Operating Earnings per share for the three-year period measured against a peer group of companies in the Russell 2000® Index.•Operating Return on Equity – Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companies in the Russell 2000® Index.•Total Shareholder Return – Relates to the Total Shareholder Return for the three-year period measured against a peer group of companies in the Russell 2000® Index.2014-2016 Long-term Incentive Plan Grants and AwardsThe 2014 awards were 100% equity-based and were comprised of 50% performance-based RSUs, 20% service-based RSUs and 30% service-based stock options. All measures are defined as relative, specified performance levels measured against a peer group of companies. The peer group of companies is made up of all insurance companies included in the Russell 2000® Index, except for brokerages, reinsurance, financial guarantee and health companies. The two relative performance measures for the 2014-2016 performance period – operating return on equity and total shareholder return – continue to support the objective of out-performing our peers as the Company focuses on investments needed in these three years to allow for strategic growth. These two measures focus on the effective use of capital and delivering on growth objectives while retaining our strong alignment with Shareholder interests. The performance measures and targets for the performance-based RSUs are as follows:2014-2016Performance Measures (1)MeasurementWeighting2014-2016Performance Period TargetsAbsolutevs. RelativeOperating Return on Equity 50%50th Percentile of Peer GroupRelativeTotal Shareholder Return 50%50th Percentile of Peer GroupRelativeTotal100%(1)The Performance Measures, as defined under the Long-term Incentive Plan, include:•Operating Return on Equity – Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companies in the Russell 2000® Index.•Total Shareholder Return – Relates to the Total Shareholder Return for the three-year period measured against a peer group of companies in the Russell 2000® Index.202016 Proxy Statement • Compensation Discussion and Analysis2015-2017 Long-term Incentive Plan Grants and AwardsThe 2015 awards were 100% equity-based and were comprised of 50% performance-based RSUs, 20% service-based RSUs and 30% service-based stock options. The 2015-2017 performance measures are comprised of two relative measures and one absolute measure. The third measure is absolute and reflects the company’s focus on year over year premium growth in all lines of business. Together, these three measures support our long term strategy to continue our effective use of capital, increasing and sustaining our momentum in profitable multiline premium growth while retaining our strong alignment with Shareholder interest. The performance measures and targets for the performance-based RSUs are as follows:Peer Group for Relative Measures• Russell 2000® Index (except for brokerage, reinsurance, financial guarantee and health companies) 40% 50th Percentile of Peer Group Relative 40% 50th Percentile of Peer Group Relative 20% 3% Absolute 100% (1)The Performance Measures, as defined under the Long-term Incentive Plan, include:•Operating Return on Equity – Relates to the average annual Operating Income return on average equity for the three-year period measured against a peer group of companies in the Russell 2000® Index.•Total Shareholder Return – Relates to the Total Shareholder Return for the three-year period measured against a peer group of companies in the Russell 2000® Index.•Total Written Premium Growth – Relates to Horace Mann written premium growth measured as the compound annual growth rate from 2014 to 2017 for Auto, Property, Annuity and Life.Long-term Incentive Target for Period beginning in 20142014 and 2015 long-term incentive2019 opportunities under LTIP for each NEO, the Committee targeted amounts that would achieve the Company’s overall objective of positioning total compensation at approximately the market median. The 2014 and 20152019 target grant values for the NEOs for the 2014-2016 and 2015-2017 performance periods were as follows: Long-term Incentive Long-term Incentive $1,000,000 $1,100,000 $500,000 $500,000 $400,000 $500,000 $175,000 $300,000 N/A (1) $300,000 N/A – Not applicable(1)Named Individual Mr. Stacy was hired in 2015.Marita Zuraitis 1,950,000 Bret A. Conklin 450,000 Matthew P. Sharpe 550,000 William J. Caldwell 425,000 Wade A. Rugenstein 300,000 We believe the RSUs are (PBRSUs)and haveperiod. Each year, a high value in promoting executive retention. RSUsnew three-year period starts, partially overlapping the periods that started the prior two years. PBRSUs were granted on March 5, 20132019 for the 2013-20152019-2021 performance period on March 5, 2014 forand comprise 50% of the 2014-2016 performance period, on March 4, 2015 for the 2015-2017 performance period.2019 LTIP opportunity. These RSUs will be earned on December 31, 2015, December 31, 2016, and December 31, 2017, respectively, based on achievements relative to the three-year performance period targets. Participants can earn up to 200% of their target award of RSUs based on performance. For the 2013-2015 program, the RSUs earned at the end of 2015 were 100% vested on January 1, 2016 following2022, if at all, based on the performance period. Under the 2014-2016 program, any RSUs earned at the endlevel of 2016 are 100% vested on January 1, 2017 following the performance period. Under the 2015-2017 program, any RSUs earned at the end of 2017 are 100% vested on January 1, 2018 following the performance period. Once vested, the RSUs are subject to holding requirements until the executive’s stock ownership requirements are met. See “Stock Ownership and Holding Requirements.”achievement. From the date of grant, RSUsPBRSUs accrue dividendsdividend equivalents at the same rate as dividends paid to our Shareholders, but the dividend equivalents are only paid on the corresponding shares that are earned. If no shares are earned, the dividendsdividend equivalents are forfeited. Earned dividendsdividend equivalents are converted into additional RSUs.Target RSU opportunities for the 2013-2015, 2014-2016, and 2015-2017 performance periods for the NEOs were established as 50% of the total long-term incentive opportunities. On an annualized basis, the awards of RSUs ranged from approximately 35% to 73% of base salary. Maximum opportunities were set at 200% of target and threshold opportunities were set at 50% of target.Each of the relative performance measures are required to be at or above the 25th percentile to earn an award. At the 25th percentile, participants can earn 50% of their target award.